Understanding Bitcoin: The Future of Digital Currency

Bitcoin, a digital currency that operates without a central authority, is revolutionizing the financial world. Since its inception in 2009, it has gained immense popularity and sparked global discussions about the future of money. Understanding Bitcoin’s unique features and its potential impact on the global economy is crucial as it continues to grow in prominence.

What is Bitcoin?

Bitcoin is a decentralized digital currency that enables peer-to-peer transactions without intermediaries like banks or governments. It was introduced by an anonymous individual or group using the pseudonym Satoshi Nakamoto. Transactions are verified through blockchain technology, which acts as a public ledger, ensuring transparency and security.

Key Features of Bitcoin

- Decentralization: Unlike traditional currencies controlled by central banks, Bitcoin operates on a decentralized network of computers worldwide.

- Limited Supply: Bitcoin has a capped supply of 21 million coins, making it immune to inflation caused by excessive money printing.

- Transparency: Every Bitcoin transaction is recorded on the blockchain, a public ledger accessible to anyone.

- Security: Bitcoin transactions are secured through cryptographic techniques, making them nearly impossible to alter.

How Does Bitcoin Work?

Bitcoin transactions are facilitated through blockchain technology. The blockchain is a series of blocks containing transaction data, which is validated by miners using computational power. Miners compete to solve complex mathematical problems, and the first to succeed adds a new block to the chain, earning Bitcoin as a reward.

The Role of Blockchain Technology

Blockchain is the backbone of Bitcoin, ensuring that transactions are secure, transparent, and immutable. Its decentralized nature eliminates the need for intermediaries, reducing costs and increasing efficiency.

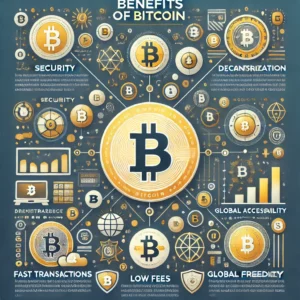

Advantages of Bitcoin

Bitcoin offers several advantages that set it apart from traditional currencies and payment systems.

1. Financial Inclusion

Bitcoin provides access to financial services for the unbanked and underbanked populations. Anyone with an internet connection can create a Bitcoin wallet and participate in the global economy.

2. Lower Transaction Costs

Traditional financial systems often involve high fees for international transactions. Bitcoin eliminates intermediaries, significantly reducing transaction costs.

3. Speed and Efficiency

Bitcoin transactions are processed quickly, even for cross-border payments. Unlike traditional banking systems, which can take days, Bitcoin transfers are completed within minutes.

4. Privacy and Security

Bitcoin allows users to maintain a level of anonymity while ensuring that transactions are secure. Personal information is not required to complete transactions, reducing the risk of identity theft.

5. Hedge Against Inflation

Bitcoin’s limited supply makes it a viable hedge against inflation. Unlike fiat currencies that can lose value due to excessive printing, Bitcoin retains its scarcity and value over time.

Challenges and Criticisms

Despite its advantages, Bitcoin faces several challenges and criticisms that must be addressed to achieve widespread adoption.

1. Volatility

Bitcoin’s price is highly volatile, making it less stable as a store of value. This volatility can deter everyday users and businesses from adopting it as a payment method.

2. Environmental Concerns

Bitcoin mining consumes significant energy, raising environmental concerns. The industry is exploring sustainable solutions, such as renewable energy sources, to mitigate its carbon footprint.

3. Regulatory Uncertainty

Governments worldwide are grappling with how to regulate Bitcoin. Regulatory clarity is essential to foster trust and encourage adoption.

The Future of Bitcoin

Bitcoin’s potential to revolutionize the financial landscape is immense. As technology advances and awareness grows, it could become a cornerstone of the global economy. Its role in decentralized finance (DeFi) and its integration into mainstream financial systems highlight its versatility and adaptability.

Bitcoin in Decentralized Finance (DeFi)

Bitcoin serves as a store of value and collateral in DeFi platforms, enabling users to access financial services without traditional intermediaries. Its interoperability with other blockchain networks further enhances its utility.

Institutional Adoption

Major institutions are increasingly recognizing Bitcoin’s potential. Companies like Tesla and MicroStrategy have invested in Bitcoin, and financial giants are offering Bitcoin-related products to their clients.

Conclusion

Bitcoin represents a paradigm shift in how we perceive and use money. Its decentralized nature, security, and global accessibility make it a compelling alternative to traditional currencies. While challenges remain, the ongoing advancements in technology and growing adoption suggest that Bitcoin is poised to play a significant role in the future of digital currency. As we navigate this evolving landscape, understanding Bitcoin’s potential and implications is more important than ever.